Tools and Resources

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use forestresearch.gov.uk, remember your settings and improve our services.

We also use cookies set by other sites to help us deliver content from their services.

Timber Price Indices are based on sales of softwood (conifers) by the Forestry Commission and Natural Resources Wales and are released every 6 months. They cover:

The Coniferous Standing Sales Price Index monitors changes in the average price received per cubic metre for timber that the Forestry Commission/ Natural Resources Wales sold standing, where the purchaser is responsible for harvesting.

The Softwood Sawlog Price Index monitors changes in the average price received per cubic metre of sawlogs (roundwood with a top diameter of 14 cm or more, destined to be sawn into planks or boards) sold at roadside by the Forestry Commission/ Natural Resources Wales.

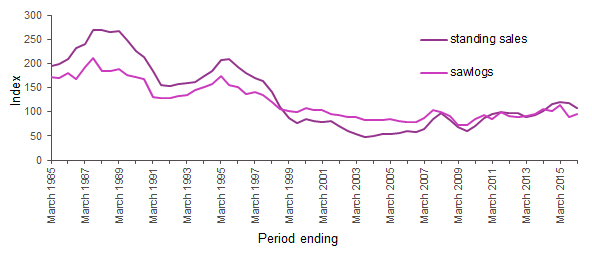

Standing timber and sawlogs are distinct markets, and may show different price movements. The data are averages for historic periods, so may be slow to show any turning points.

These indices are used to monitor trends in timber prices and to provide information on the state of the UK timber industry. They are also used by the UK timber industry, alongside other economic indicators, in contract reviews.

There is little other information currently available on wood prices before primary processing and no price index is available for broadleaves. Prices for outputs of primary wood processing are collected by the Office for National Statistics (ONS) in the Producer Price Indices (PPIs), and these are available in the MM22 Business Monitor which gives detailed PPIs monthly.

Table 8.1 presents the coniferous standing sales and sawlog price indices for Great Britain to March 2016.

The coniferous standing sales price index for Great Britain was 9.7% lower in real terms in the year to March 2016, compared with the previous year (Table 8.1). The softwood sawlog price index was 16.7% lower in real terms in the 6 months to March 2016, compared with the corresponding period in the previous year.

| Period ending March | Standing sales2 | Sawlogs | |||

|---|---|---|---|---|---|

| Nominal terms3 | Real terms4 | Nominal terms3 | Real terms4 | ||

| index (period to September 2011 = 100) | |||||

| 2007 | 57.2 | 64.2 | 78.1 | 87.2 | |

| 2008 | 89.6 | 97.8 | 91.5 | 99.2 | |

| 2009 | 64.0 | 68.1 | 67.5 | 71.4 | |

| 2010 | 67.5 | 70.1 | 83.3 | 85.8 | |

| 2011 | 93.5 | 94.3 | 85.7 | 85.8 | |

| 2012 | 97.5 | 96.9 | 91.7 | 90.6 | |

| 2013 | 91.3 | 89.1 | 93.7 | 91.0 | |

| 2014 | 105.5 | 100.8 | 110.3 | 105.0 | |

| 2015 | 126.4 | 119.0 | 120.3 | 113.5 | |

| 2016 | 114.4 | 107.5 | 100.3 | 94.5 | |

Source: Timber Price Indices: data to March 2016

Notes:

1. The price indices are constructed from information on sales by the Forestry Commission/ Natural Resources Wales only.

2. Until November 2008 the Laspeyres method was used to calculate the standing sales index to take account of the size mix. Since then the Fisher method with 5 year chain linking has been adopted and has superseded the Laspeyres method, following a period of transition. The figures shown here are from the Fisher chain-linked index.

3. Nominal prices are the actual prices at that point in time.

4. Real terms values are obtained by using the GDP deflator to convert to “constant prices” (in this case prices in 2011). This allows trends in timber prices to be tracked without the influence of inflation.

Figure 8.1 Coniferous standing sales and sawlog price indices1,2 in real terms3, 1985-2016

Source: Timber Price Indices: data to March 2016

Notes:

1. The price indices are constructed from information on sales by the Forestry Commission/ Natural Resources Wales only.

2. Until November 2008 the Laspeyres method was used to calculate the standing sales index to take account of the size mix. Since then the Fisher method with 5 year chain linking has been adopted and has superseded the Laspeyres method, following a period of transition. The figures shown here are from the Fisher chain-linked index.

3. Real terms values are obtained by using the GDP deflator to convert to “constant prices” (in this case prices in 2011). This allows trends in timber prices to be tracked without the influence of inflation.

Cookies are files saved on your phone, tablet or computer when you visit a website.

We use cookies to store information about how you use the dwi.gov.uk website, such as the pages you visit.

Find out more about cookies on forestresearch.gov.uk

We use 3 types of cookie. You can choose which cookies you're happy for us to use.

These essential cookies do things like remember your progress through a form. They always need to be on.

We use Google Analytics to measure how you use the website so we can improve it based on user needs. Google Analytics sets cookies that store anonymised information about: how you got to the site the pages you visit on forestresearch.gov.uk and how long you spend on each page what you click on while you're visiting the site

Some forestresearch.gov.uk pages may contain content from other sites, like YouTube or Flickr, which may set their own cookies. These sites are sometimes called ‘third party’ services. This tells us how many people are seeing the content and whether it’s useful.